AVOIDING THE NEXT TRICOLOR: A Call for Dynamic Dealer Risk Management

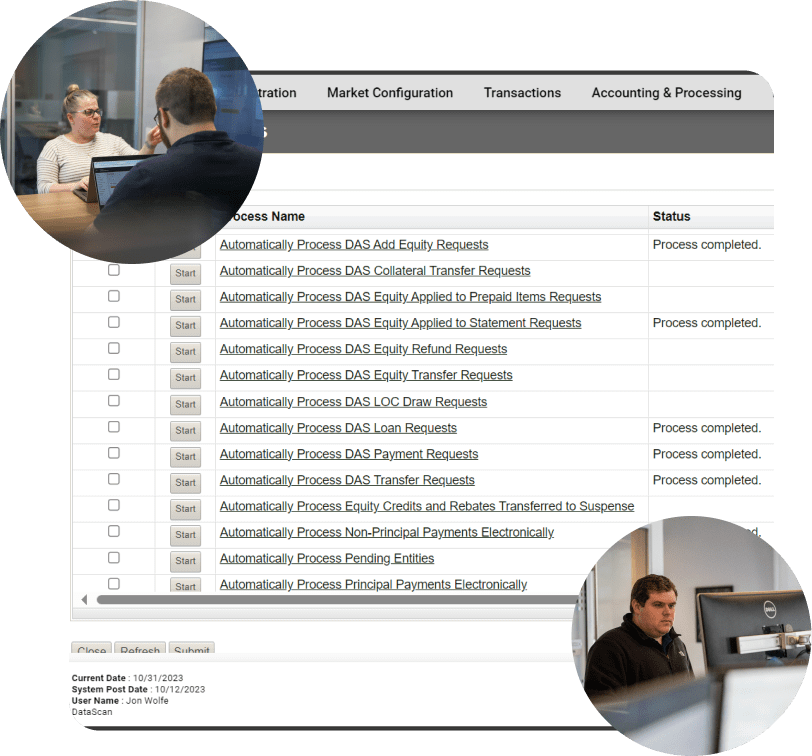

Tricolor’s 2025 collapse exposed the risks of static dealer oversight and outdated monitoring practices. Duplicate flooring, title gaps, and servicing failures went unchecked, resulting in major lender losses. This case highlights the urgent need for continuous, data-driven monitoring and proactive risk management. With modern platforms like RiskGauge, lenders can detect red flags early, respond faster, and enhance transparency—turning potential losses into actionable insights.